If you’re like most homeowners, you probably went through a local or national bank to get a mortgage. After a month or two, you probably then received a letter saying your mortgage had been sold and to start making payments to the new lender. This scenario is very common and is an accepted practice within the banking industry. But did you know that homeowners can do the same? That’s right! You can sell your mortgage just like a big bank! This article will show you how to sell your mortgage and explain the benefits Good Vibes Homebuyers delivers when we buy houses subject to the existing mortgage.

What’s in it for you:

- What it means to sell a home subject-to

- How selling your home subject to the mortgage works

- Reasons homeowners consider selling subject-to

- The Pros and cons of selling a house subject-to

- Common questions and answers about selling subject-to

What it means to sell your home subject to the existing mortgage

Selling “subject-to” the existing mortgage means selling your home and keeping the existing mortgage in place. You get paid for your equity, and iBuyMSP (iBuy) takes over the remaining mortgage balance. As the new owner, (iBuy) makes the monthly mortgage payments, pays the property taxes, insurance, HOA dues, and all other obligations related to the home. Selling subject-to your existing mortgage is quite simple and is a valuable choice for homes and homeowners in nearly all situations.

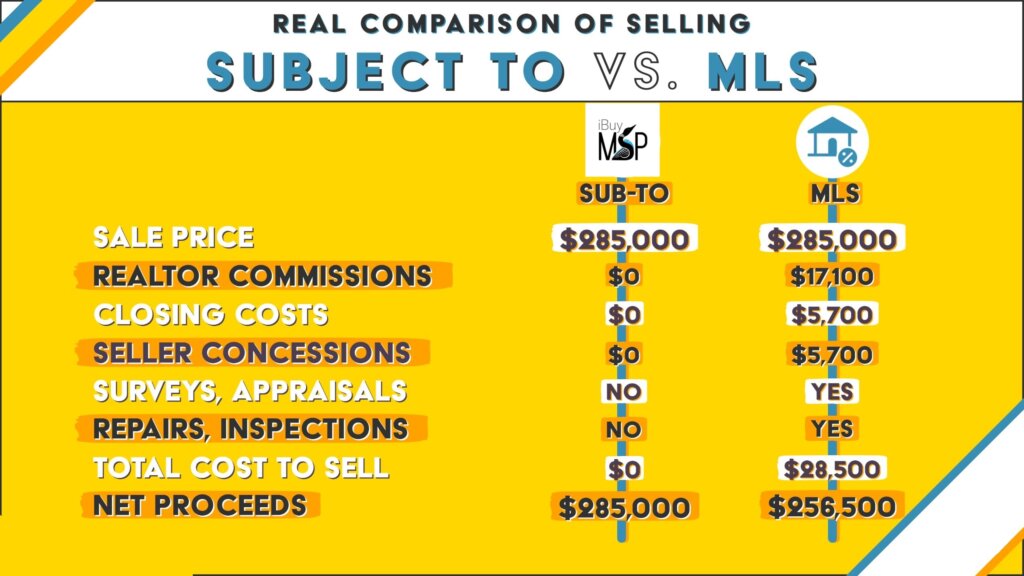

When selling subject-to the existing mortgage, iBuyMSP is able to give sellers like you more money because you aren’t having to pay traditional costs like realtor commissions (6% savings), closing fees (2% savings), and seller concessions (2% savings). When we buy your home subject-to its existing mortgage, we pay all closing costs and buy the home in “as-is” condition, which means you have zero repair costs (1+% savings).

Because iBuy avoids future financing costs when you sell your mortgage, we pass that cost savings onto you, which means more money in your pocket. At closing you receive a direct cash payment which is based on your home’s condition, mortgage payment, equity, and the estimated monthly rent.

Below is a real comparison of a subject-to the existing mortgage offer that was accepted by a homeowner who sold their mortgage to iBuyMSP:

Why homeowners consider selling subject to the existing mortgage

The biggest perk of selling your home subject-to is that it reduces transactional costs for both buyer and seller. This means 3 things: (1) sellers have zero expenses, (2) iBuy has zero financing costs, and (3) iBuy passes its cost savings onto the seller. Other reasons for selling your house subject to the existing mortgage are situations where homeowners (a) need fast cash, (b) are behind on mortgage payments (c) are facing foreclosure, (d) have little or no equity, (e) want to improve their credit, and (f) want to get the most money possible.

The pros and cons of selling your home subject-to

No matter the method for selling your home, each has their benefits and drawbacks. Selling subject-to is no different. In most situations, however, the benefits outweigh the disadvantages. So, what are the pros and cons of selling a house subject to?

Potential pitfalls of selling your home subject to

a. Due on sale clause. Every mortgage has a provision that is commonly referred to as the due-on-sale clause which says that the lender has the right, but not the obligation, to call the mortgage due upon a change in ownership. On the surface, this seems quite scary; however, banks rarely, if ever, invoke this clause. Consider the advice of David Willis, a highly regarded Texas real estate attorney:

“Due-on-sale merely enables the lender to choose to act – if the seller transfers title, then the lender may demand that the mortgage be paid off. But the lender would have to decide that such action is in its best interest, and most balk at accelerating an otherwise performing loan. Experience shows that the risk of acceleration is small while the loan remains current.” (iBuyMSP will catch-up all missed payments to bring your loan current.)

This clause has never been invoked on any of the homes we’ve bought subject-to. In fact, we’ve never heard of this happening in our network circle.

b. The mortgage is a VA Loan. Although with VA loans you absolutely can sell a home subject to its existing mortgage, one must note that it could impact your ability to obtain another VA loan in the future. To stay within the VA mortgage entitlement limit, the total amount of all VA loans in the name of a single individual cannot exceed $647,200. Even though obtaining a 2nd VA loan is possible, we must reiterate that there are specific criteria that must be met and therefore we encourage homeowners to speak with a reputable VA lender or to investigate other low-cost mortgage options like Fannie Mae, Freddie Mac, and FHA loans.

c. The mortgage stays in your name. For some homeowners, this may not be ideal while for others, it’s extremely beneficial. Homeowners who intend to buy a new home after selling their old home, may not be immediately eligible for a new mortgage if they do not meet standard underwriting requirements. Conversely, homeowners with poor credit will see a boost in their credit score as iBuy continues to make the monthly mortgage payments (iBuy has never missed nor made a late mortgage payment).

Advantages of selling my home’s mortgage

a. Make more money: In most situations you will make more money than you would with a traditional sale. Here’s why: (i) you pay no closing costs, (ii) iBuy pays no financing costs, and (iii) iBuy passes its savings on to you. In short, you have no expenses, our costs are reduced, and therefore we can pay you more.

b. Make money even with no equity: Homeowners with less than 11% equity who try to sell traditionally will have to bring money to the closing table. When selling your home subject to its existing mortgage where you have 11% or less in equity, iBuyMSP can still pay you up to $10,000.

c. Your mortgage is brought current: If you’re behind on mortgage payments, iBuyMSP will catch-up all missed payments so that your loan is brought current. This is a critical step to improving your credit.

d. Fastest closing: Homeowners who need fast cash or a quick closing can sell their home subject to the existing mortgage in as little as 1 day. Closing a traditional sale averages 45-90 days.

e. No inspections, repairs, surveys, or appraisals: You went through this process when you bought the home. Because you already have a loan in place, there is no need to repeat these steps, so closing a subject to mortgage is very simple!

f. Easiest closing: Our team provides full-service “sell your mortgage services” meaning we complete all tasks needed to close. On occasion, you will need to provide basic information but your most time intensive obligation will be signing closing documents and collecting your cash.

How We Keep You Covered

Our team knows how important this transaction is for you and for us, so we take every step possible to make sure you’re covered. First, by having a licensed attorney complete all of the paperwork and closing documents. Next, by filing a “pre-signed deed” with the attorney in the case that we are ever 60 days late on the payment. That way, you would get the property back immediately, no foreclosure or eviction court. In that case, you would benefit from any repairs and updates we have made, and any money that we’ve already given you.

We are happy to answer any questions you might have, and be as transparent as possible to ensure you are comfortable with selling your mortgage to us.

Contact Us

We would love to hear from you! Please fill out this form and we will get in touch with you shortly.